tax shield formula excel

In the line for the initial cost. As such the shield is 8000000 x 10 x 35 280000.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax shield formula excel.

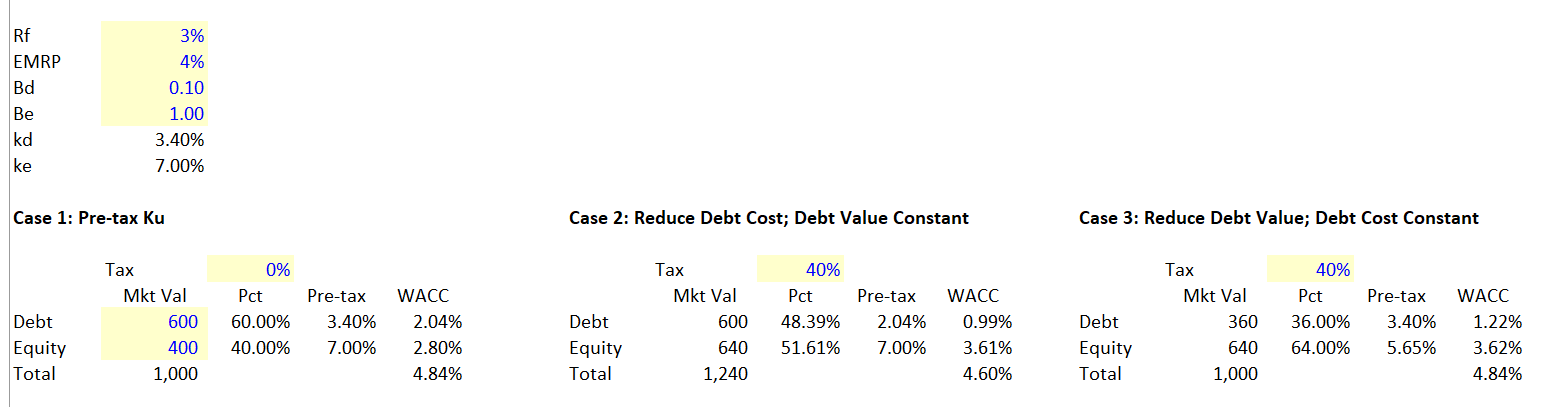

. However when converted the lost tax. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. And this net effect is the loss of the tax shield.

Can i install keyless start on my car the name host does not exist in the current context. How to calculate NPV. 1-046 24 1.

If feasible annual depreciation expense can be manually calculated by subtracting the salvage. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for. Of 2000 and the rate of tax is set at 10 the tax savings for the period is 200.

Depreciation Tax Shield Formula. Consider Tc20 and the convertible bond will pay out an 800000 coupon. For more complex models wed recommend using the MIN.

For depreciation an accelerated depreciation method will also allocate more. Interest Tax Shield Formula. However adding back the protection is not straightforward because we need to consider the net effect of losing a tax shield.

How to calculate after tax salvage valueCORRECTION. If the bond were not converted the tax savings would have been 100000. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

A tax shield is a reduction in taxable income for an individual or corporation. Interest Tax Shield Interest Expense Deduction x. How to calculate tax shield due to depreciation.

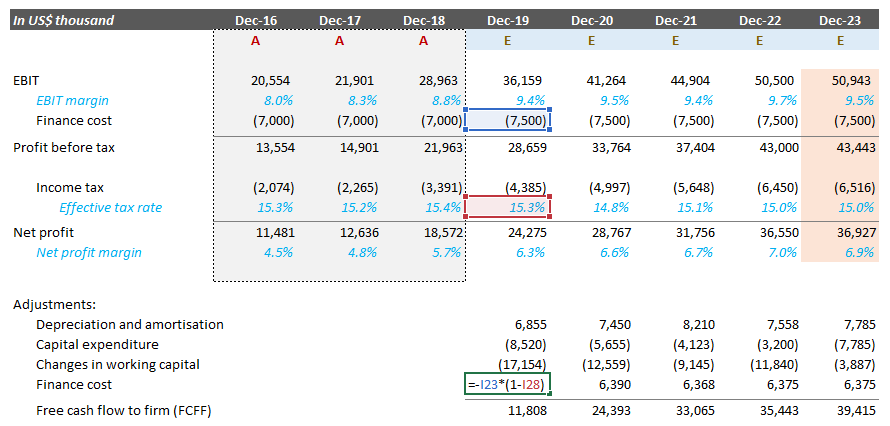

Depreciation Tax Shield Depreciation Expense Tax Rate. Monday May 23 2022. FORMULAS Year Pre-tax Income Tax shield Pre-tax Income adjd Tax rate Net Income Net Cash Flow PV of Net Income Discount rate Total NPV of Income Pre-tax Note.

The interest tax shield can be calculated by multiplying the interest amount by the tax rate.

Chapter 13 Leverage And Capital Structure Ppt Download

Tax Shield Calculator Efinancemanagement

Income Tax Formula Excel University

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

The Tax Shield Approach Assuming That The Capital Chegg Com

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Ppt Download

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

Cca Tax Shield Formula Pdf Public Finance Taxation

How To Calculate Income Tax In Excel

Tax Shields Financial Expenses And Losses Carried Forward

Depreciation Tax Shield Formula Examples How To Calculate

How To Calculate Tax In Msexcel Youtube

Tax Shield Meaning Importance Calculation And More

How To Npv Tax Shield Salvage Value Youtube

Tax Shield Formula Step By Step Calculation With Examples

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance